Head Of Household Standard Deduction 2025. Standard deduction 2025 over 65. If you’re the head of your household, it’s $21,900.

For the 2025 tax year (for forms you file in 2025), the standard deduction is $13,850 for single filers. The standard deduction for 2025 varies depending on filing status.

Married couples filing jointly will see a deduction of $29,200, a boost of $1,500 from 2025, while heads of household will see a jump to $21,900 for heads of household,.

For the 2025 tax year, the additional standard deduction amounts are $1,850 for single filers or heads of household and $1,500 for married filers or qualifying widow.

2025 Tax Rates, Standard Deduction Amounts to be prepared in 2025, The 2025 standard deduction for tax returns filed in 2025 is $13,850 for single filers, $27,700 for joint filers or $20,800 for heads of household. The standard deduction gets adjusted regularly for inflation.

The IRS Just Announced 2025 Tax Changes!, Single or married filing separately: The standard deduction gets adjusted regularly for inflation.

2025 IRS Inflation Adjustments Tax Brackets, Standard Deduction, EITC, Itemized deductions can also reduce your taxable income, but the amount varies. The federal standard deduction for a head of household filer in 2025 is $ 20,800.00.

Even if you don't have a lot of itemized deductions to file, you still, For the 2025 tax year, the additional standard deduction amounts are $1,850 for single filers or heads of household and $1,500 for married filers or qualifying widow. The standard deduction for 2025 varies depending on filing status.

Standard Deduction For 2025 22 Standard Deduction 2025 www.vrogue.co, The new york standard deduction is thousands of dollars less than the feds allow. For single filers and married individuals filing.

How much do Isagenix essential oils cost compared to doterra oils and, The top marginal tax rate in tax year 2025, will. Standard deduction 2025 over 65.

MintLife Blog, And have until october 15, 2025 to finish and file your new york tax return. You can file as head of household if you are unmarried,.

Head Household Standard Deduction In Powerpoint And Google Slides Cpb, Head of household is an irs filing status you can claim if you’re unmarried and support someone, such as a child or relative. For single filers and married individuals filing.

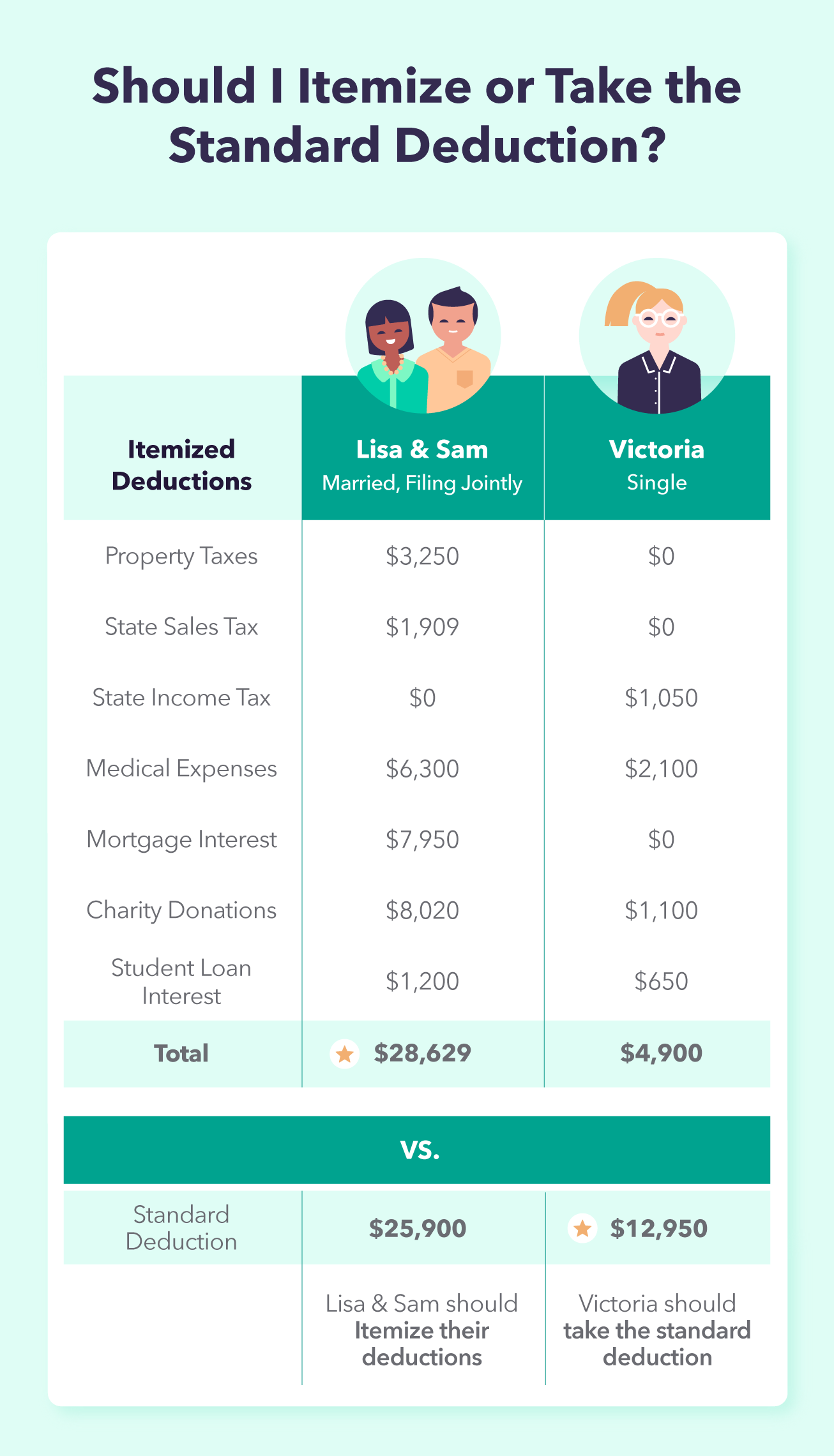

Should You Take The Standard Deduction on Your 2025/2025 Taxes?, The basic standard deduction, which most people will use for the 2025 return they file this year, is based on your filing status. Head of household is an irs filing status you can claim if you’re unmarried and support someone, such as a child or relative.

Standard Deduction 2025? College Aftermath, Standard deduction 2025 over 65. And have until october 15, 2025 to finish and file your new york tax return.

Married couples filing jointly will see a deduction of $29,200, a boost of $1,500 from 2025, while heads of household will see a jump to $21,900 for heads of household,.

For the 2025 tax year (for forms you file in 2025), the standard deduction is $13,850 for single filers.